vermont department of taxes myvtax

Our tax examiners are available Monday through Friday from 745 am. Register or Renew a Vehicle Find all of.

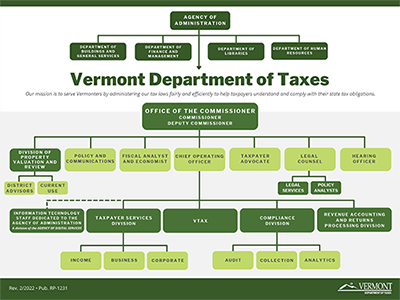

Organization Department Of Taxes

Our office hours are 745 am.

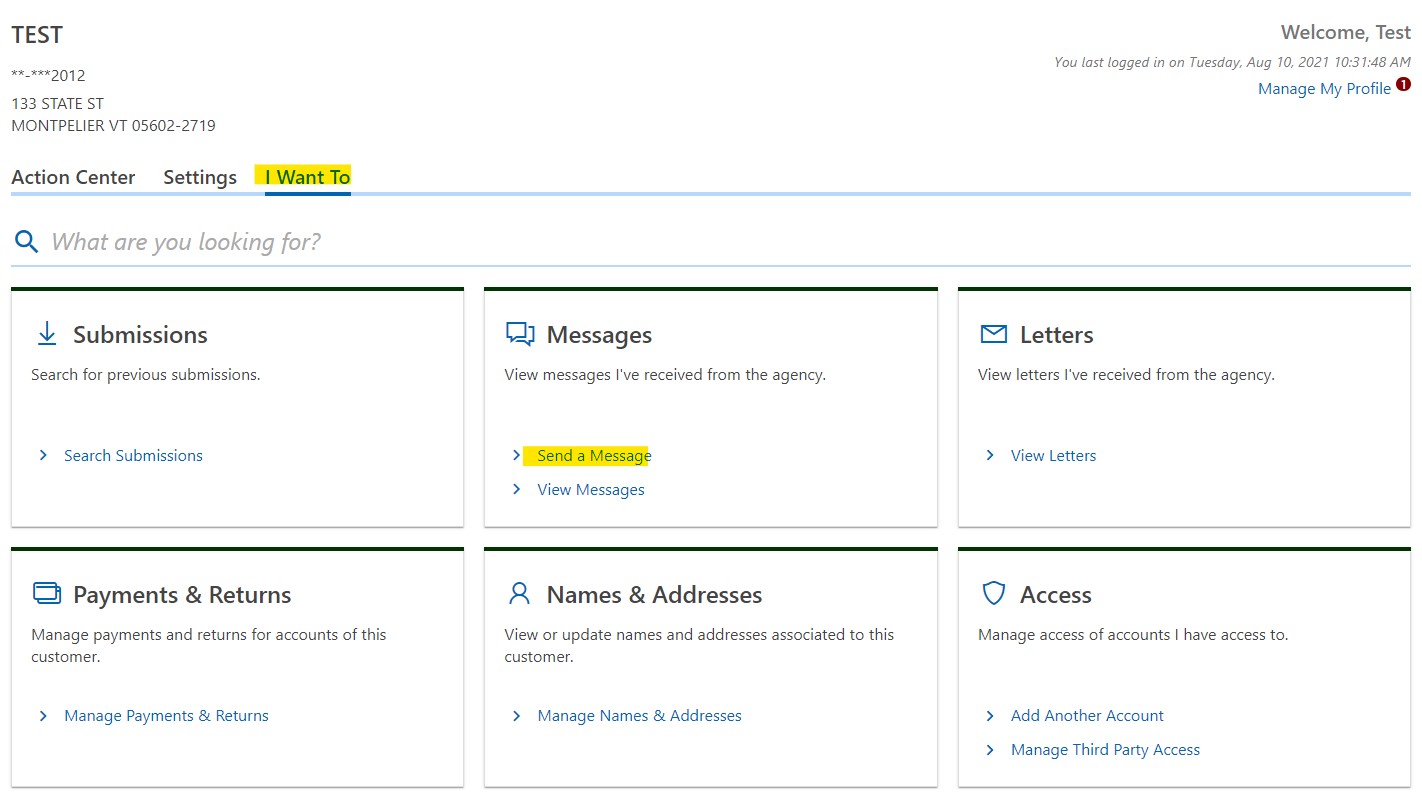

. Taxes for Individuals File and pay taxes online and find required forms. Activate an account using a myVTax Access Code. Ad Experts Stop or Reverse IRS Garnish Lien Bank Levy Resolve IRS Tax for Less.

You may submit all forms schedules and payments by personal check cashiers check or money order in person to. Department of Taxes Payroll companies and employers should Use myVTax. 133 State Street 1st Floor.

Our tax examiners are available to answer your questions about myVTax Monday through Friday from 745 am. You can also email myVTax support or call us at 802-828-6802 or 802-828-2551. Register as an accountant attorney or third party tax professional to access client accounts.

Electronic Transfer of W-2 1099 and WH-434 Filings. Fields marked with an asterisk are required. You have been successfully logged out.

Vermont School District Codes. IN-111 Vermont Income Tax Return. Sign Up for myVTax.

802-828-2865 or toll free in Vermont 866-828-2865 on Monday Tuesday Thursday and Friday from 745 am to 430 pm. File or Pay Online. Get Help with myVTax.

Because this is less than 25 enter 0000. The 2083 business use 2501200 is rounded to 21. Tax examiners in this division can answer questions about Vermont personal income tax Homestead.

Our tax examiners are available to answer your questions about myVTax Monday through Friday from 745 am. We would like to show you a description here but the site wont allow us. Department of Taxes The eCuse system allows property owners to submit online applications to the Current Use Program and allows town clerks assistant town clerks and listers to view Current Use applications.

B 1200 square foot home with 250 square feet used as a home office. We are here to answer any questions you have about myVTax. Use myVTax the departments online portal to e-file your meals and rooms sales and use.

The Vermont Department of Taxes offers several eServices for individual taxpayers and businesses through myVTax the departments online portal. Please include your Business Tax Account number. Ad New State Sales Tax Registration.

Ad Learn How Long It Could Take Your 2021 State Tax Refund. Register or Renew a Vehicle Find all of the resources you need to register and renew your vehicle in Vermont. Please provide a daytime number where you can be.

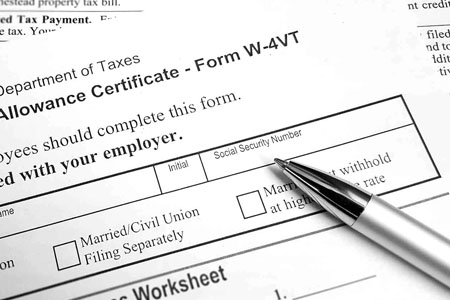

W-4VT Employees Withholding Allowance Certificate. Instructions for State of Vermont Departments How to Remit Tax Collections through ACH Credit Processing to the Vermont Department of Taxes Via the Vision Accounts Payable Module. MyVTax Payment Portal Vermontgov Freedom and Unity.

FY2023 Property Tax Rates. To 430 pm Monday through Friday. If your email address has changed since the time you first registered or you experience any other problem with your password or username please contact the Taxpayer Services Division or by completing the form below.

See How Long It Could Take Your 2021 State Tax Refund. Vermont Department of Taxes. The portion used for business is taxed at the nonhomestead rate.

745 AM - 430 PM. PA-1 Special Power of Attorney. Add myVTax access for an existing Vermont Tax account.

Vermont Department of Taxes 133 State Street Montpelier VT 05633 Click here for phone numbers Local. You may now close this window. The 3528 is business use 6351800 is rounded to 3500.

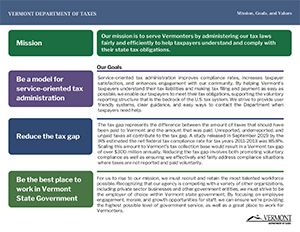

Our mission is to serve Vermonters by administering our tax laws fairly and efficiently to help taxpayers. Send us a message in the form below. Freedom and Unity Live Common Services.

802-828-2865 or toll free in Vermont 866-828-2865 on Monday Tuesday Thursday and Friday from 745 am to 430 pm. How Can We Contact the Vermont Department of Taxes for questions about Vermont personal income taxes. Claim The Money You Deserve.

Listers should contact the Department of Taxes to request account set up. Use myVTax the departments online portal to electronically pay personal income tax estimated tax and business taxes. Mon 02222021 - 1200.

Vermont State Tax information registration support. Understand and comply with their state tax obligations.

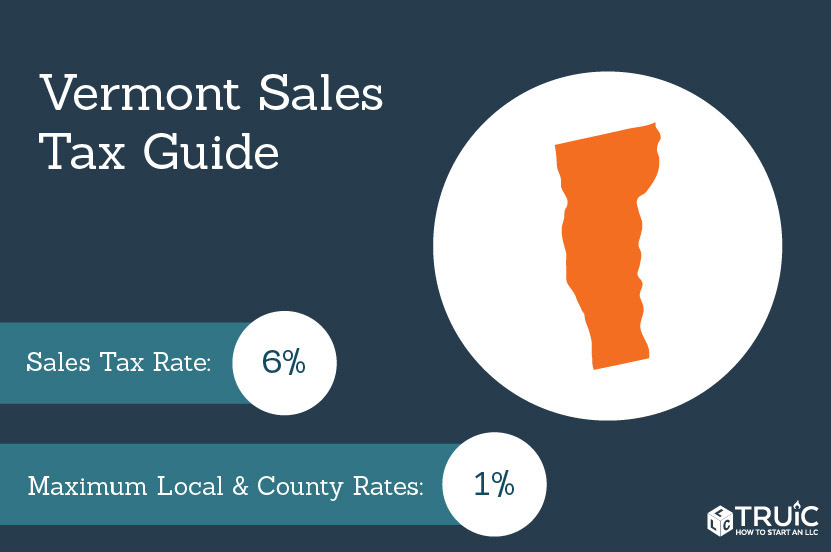

Vermont Sales Tax Small Business Guide Truic

Personal Income Tax Department Of Taxes

Vermont Department Of Taxes Facebook

Declaring Your Vermont Homestead Most Situations The Basics Youtube

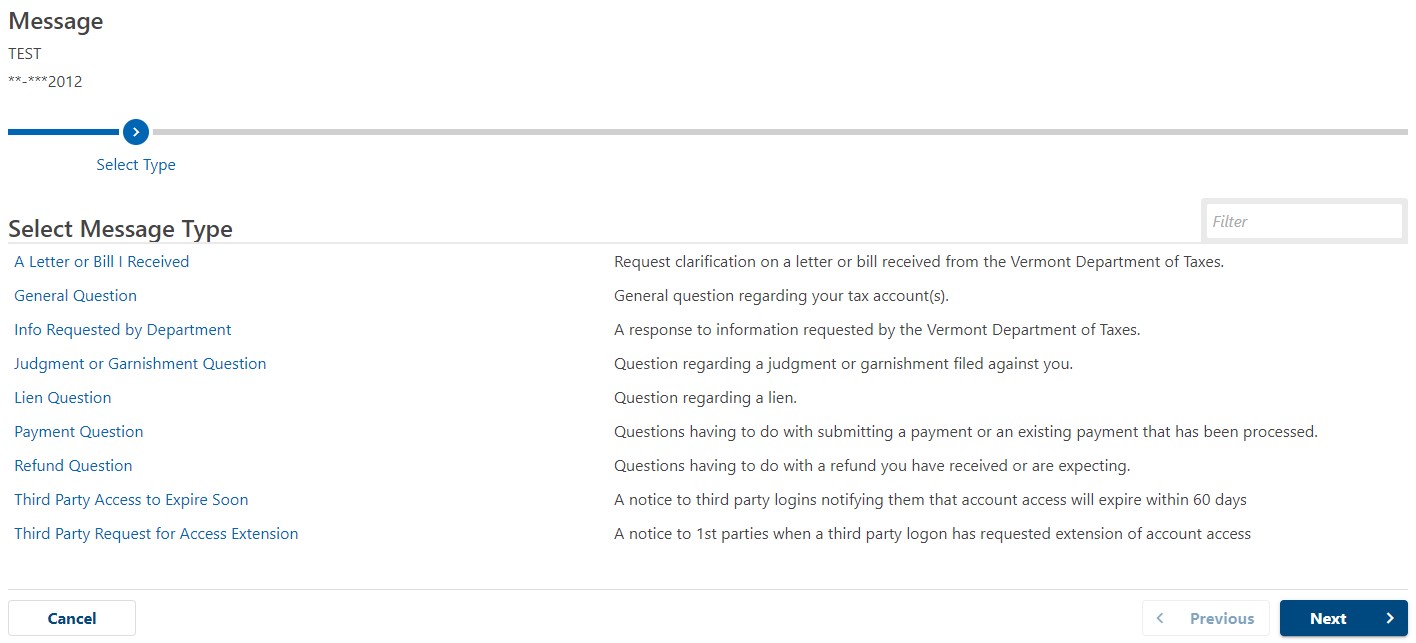

How To Send A Secure Message Department Of Taxes

Vermont Department Of Taxes Facebook

Vermont Department Of Taxes Facebook

How To File A Renter Credit Claim In Myvtax Form Rcc 146 V4 Youtube

File A New Vermont W 4vt Department Of Taxes

Personal Income Tax Department Of Taxes

About The Department Department Of Taxes