how to decide on term life insurance

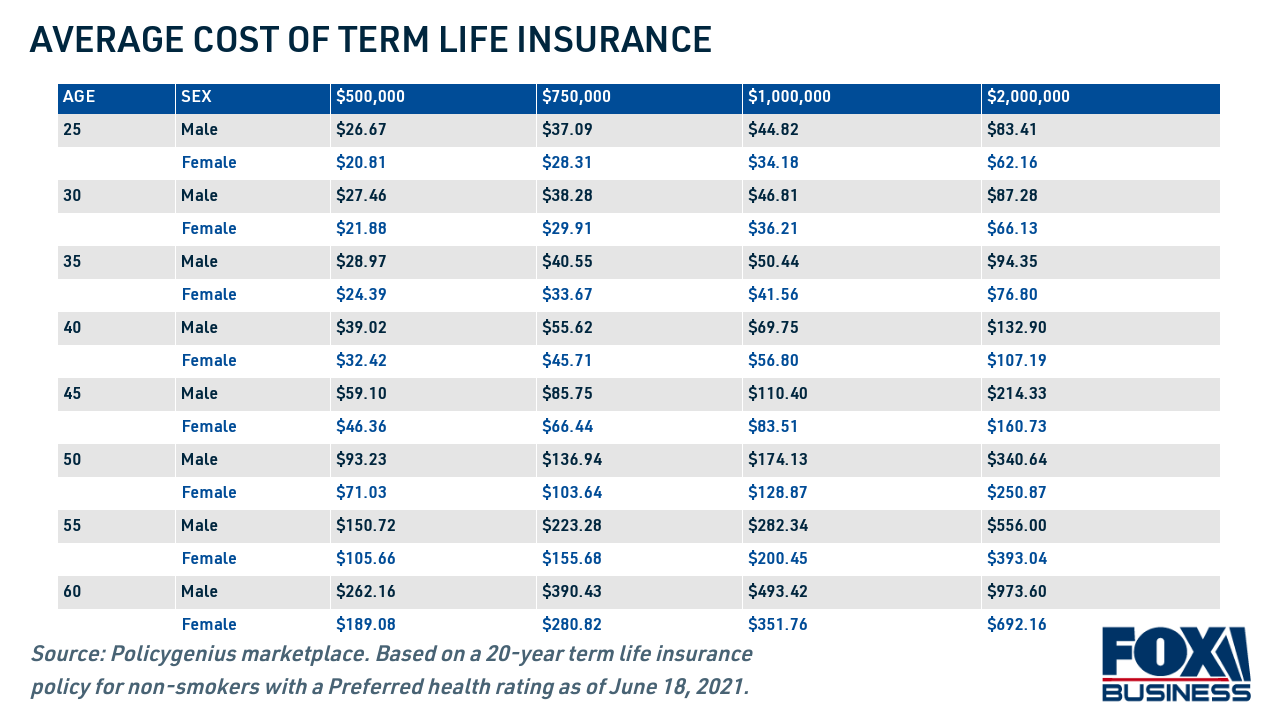

Whole life insurance monthly premiums are higher than term life premiumsfive to fifteen times higher. Term life insurance provides you with coverage for a set time.

Term Life Insurance Vs Whole Life Insurance Which Should You Get Planner Bee

This method has you multiplying your annual gross income by 70 and then multiplying that by 7.

. Permanent insurance which covers you for as. As the name suggests term life insurance covers you in the event of unexpected death during a specified term. By Trae Norrell Account Executive As we get older we begin to realize the importance of having a good life insurance policy in place.

Determining How Long Your Term Length Should Be. Premiums drop several dollars a month compared to 30-year policies but you. Choose a shorter term for coverage.

Do we choose 15 20 or 30 years for the term. However the word that requires to be determined may be a complicated. The primary difference between whole life insurance and term life insurance is the duration of the policy.

How To Choose Best Term Insurance Plan. Just unsure of how long the term should be. Liberty mutual insurance company is an insurance company which offers coverage for individuals families and businesses.

For many a 20-year term is a popular option because of its hybrid of length and affordability. Life insurance has many variations such as term insurance ULIP endowment scheme and so on. This gives you 7 years of wages at.

Think about how long you need to be insured in order to provide some financial protection to your loved. Any comparison of the. Be specific about the time you would require the cover for.

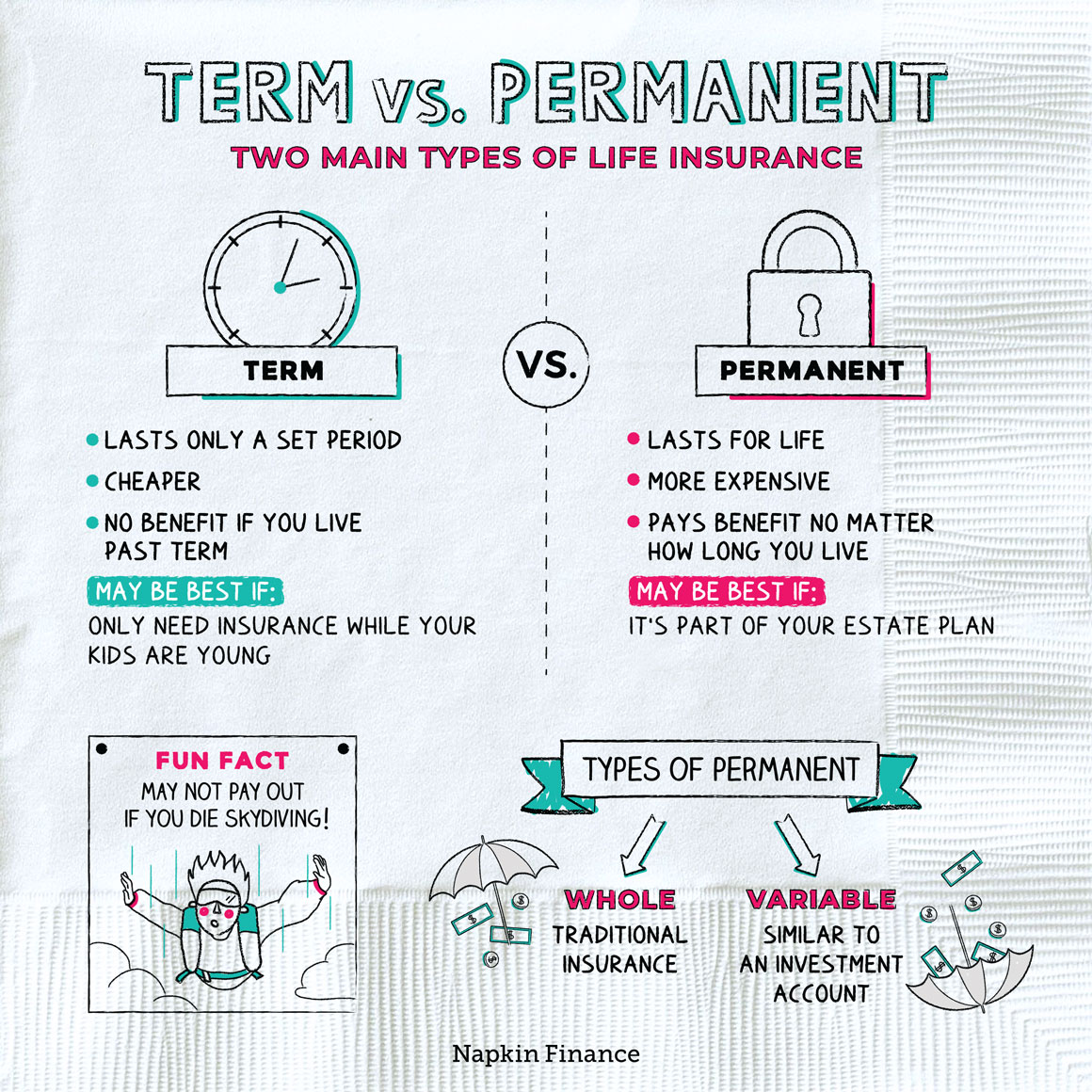

If the term life insurance policy. Often young families seek out term life insurance quotes to cover wage. The two main types of life insurance are.

How to choose length of term life insurance. Your term insurance coverage should broadly assess. Tips for saving money on term insurance include.

A term insurance policy must cover a person till the age. Whether youre just starting your family or nearing. Also known as pure life insurance term life insurance is a type of policy that guarantees payment of a death benefit during a set term.

Husband and I are 3435 and healthy. Identify your needs and the term insurance coverage you seek. Term insurance which covers you for a specified period of time and is more affordable.

Term life insurance is only in effect for a specified duration usually in. Payout If your premium payments are current your beneficiary is. The tenure of the term insurance plan is as crucial as the amount of cover.

By making sure you have the right life insurance policy your loved ones wont be forced to make huge changes like selling the house to make ends meet and can keep going. Lower the amount of life insurance. Once the need for life insurance is determined the discussion almost invariably turns to the choice of term life insurance versus whole life or permanent insurance.

The first method is called the easy method. It delivers protection to your beneficiaries if you die prematurely which is why term life insurance also means pure. Compare pricing from multiple insurance companies.

Choosing A Life Insurance Term Money

A Financial Planner Explains How To Choose A Life Insurance Policy

What Type Of Life Insurance Policy Do I Need

10 20 Or 30 Years Choosing Term Life Insurance Length Bestow

Term Vs Permanent Life Insurance Napkin Finance

Is Your Term Life Insurance Rate Locked In 2022

How Much Should Life Insurance Cost See The Breakdown By Age Term And Policy Size Fox Business

Term Life Over 50 The Guide You Ve Been Looking For Jrc Insurance Group

How Term Life Insurance Can Help You 1891 Financial Life

Term Life Vs Whole Life Insurance How To Decide Hunt Insurance

Term Life Vs Whole Life Insurance Moneyunder30

Selecting Life Insurance Choose Term Independent Financial Planning

Whole Or Term Life Insurance Which One Should You Buy

What Is Term Life Insurance U S News World Report

How To Lower Your Life Insurance Premium

When Whole Life Insurance Is Better Than Term Life Insurance With 10 Real World Examples

Life Insurance Consulting Advice Los Angeles

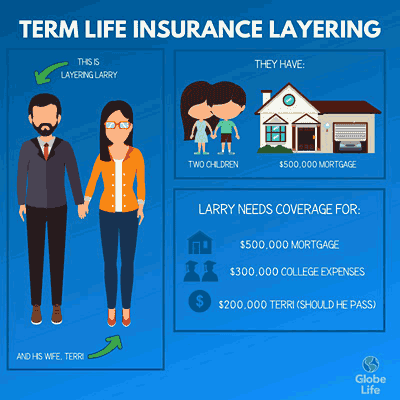

Layering Term Life Insurance Could Save You Money Globe Life